Digital payments have always enjoyed rising popularity in the last decade or so – but the recent global pandemic has supercharged its growth. Overall trends of increased digitalization and the adoption of technology are seeing people move further away from cash and credit cards to embrace digital wallets and QR code payments. With a population that has become more reliant on their smartphones than computers for internet access, it’s no wonder that more and more people are paying for purchases with their phones instead of swiping their credit cards or handing over cash.

At G-EMx, we want to be part of the solution in making digital payments more accessible, convenient, and trustworthy. If you’re new to us, here’s a quick introduction about our digital payment services and how we can help secure and ease your business’s payment processes.

1. GET PAID SEAMLESSLY

Enjoy the flexibility of accepting international payments in USD, EUR, GBP and over 30 other currencies from businesses or companies via our global receiving account. Spare your business partners and clients from having to figure out confusing remittance instructions: with us, they’ll enjoy a clear and seamless user experience when you direct them to our platform to send you payments.

You’ll also get instant access to the funds – no need to wait several days for your bank to process the payment, which is commonly the case for traditional banks who need extra time to process international payments.

2. SEND MONEY TO SUPPLIERS & PARTNERS ACROSS BORDERS AND CURRENCIES WITH LOW CHARGES

Similarly, when it’s your turn to send money to business partners and vendors, you can use your G-EMx account to conveniently access payees in 180+ countries. We also support 46 currencies and offer competitive exchange rates.

We know transparency matters to you, which is why we’ll show you the exchange rate and transfer fee before proceeding. This lets you compare our rates with other providers for added assurance that we’re offering you the best value for our international payment transfer services.

3. KEEP YOUR MONEY IN MULTIPLE CURRENCIES AND AVOID LOSING MONEY THROUGH UNNECESSARY CONVERSIONS

Each time you convert currency, you lose a small fraction of your money through the exchange as banks and financial service providers take a small cut for the transaction. Over time, through multiple conversions in and out of your local currency, these amounts add up, which is why having a multi-currency wallet can help to reduce your business’s operating costs and increase your profit margins.

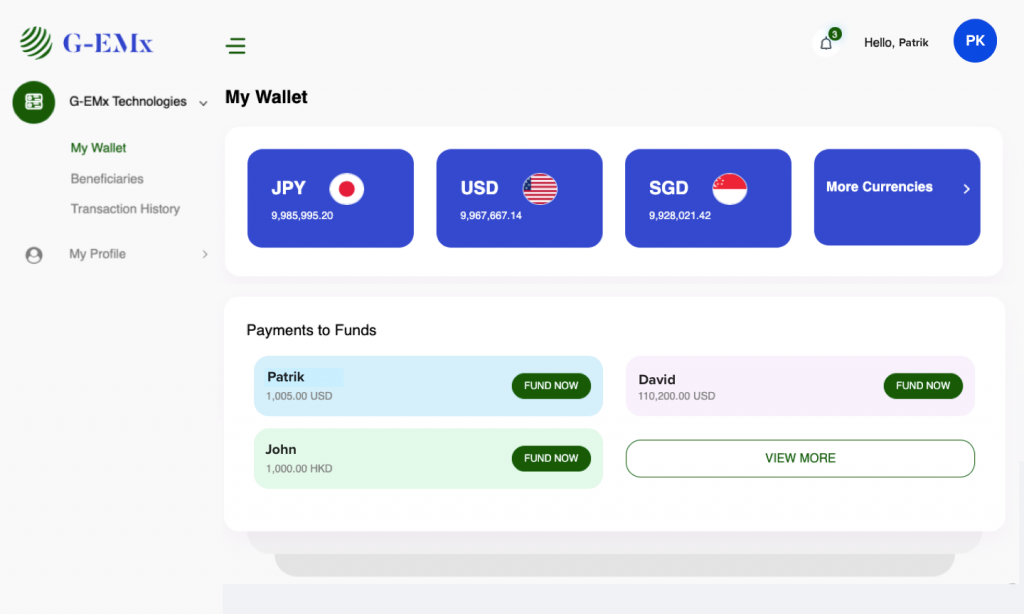

To help you preserve your business’s wealth, our G-EMx wallet offers you the option of keeping your money in multiple currencies. There are no hidden charges for doing this nor minimum balance requirements.

4. MANAGE YOUR MONEY USING OUR SMOOTH INTERFACE

Our users are in the centre of our designs when we started to build our G-EMx platform. We’ve made it one of our top priorities to offer a smooth and simplified navigational experience. Say goodbye to confusing online banking websites and look forward to our easy to use and delightful dashboard where you can manage your funds and payments effortlessly.

We’ve also built-in automation features, such as a smart workflow to handle multi-level approvals for payments and enabling bulk payments to enhance your business’s productivity. These are just the beginning as we have plans for more intelligent features to be rolled out later – stay tuned for subsequent updates!

Create your G-EMx wallet today!

Download our G-EMx mobile app (Android and iOS) and register for a free account now! If you have questions for us, contact us today to arrange a free consultation on how G-EMx can strengthen your sales and finance operations with our digital payment services.